2024 Guide to Investing in Panama

Panama is a country that offers many opportunities for investment. In this guide, we will show you the process of investing in Panama real estate.

Welcome to YourPanama.com, your gateway to the captivating world of Panama's cultural heritage. Since its inception in 2004, we have been dedicated to preserving and sharing the rich traditions, arts, and real estate offerings that make Panama truly unique.

For over 20 years, YourPanama.com has been your trusted source for insightful content spanning the cultural tapestry of Panama. Our articles have delved deep into the captivating realms of Totumas, preserving the fading art of bowl making that is an integral part of Panama's heritage. We've unraveled the stories behind Panama's traditional clothes, capturing the essence of history and intertwined fashion. Our exploration hasn't stopped there; we've also navigated the intricate history and significance of the Panama Canal, a true testament to the country's global impact.

Moreover, we're proud to have fostered connections and facilitated countless successful transactions between sellers and buyers of real estate in Panama. Our for Sale by Owner section is renowned for being one of Panama's largest hubs for private real estate listings.

Panama is a country that offers many opportunities for investment. In this guide, we will show you the process of investing in Panama real estate.

Panama is a country full of culture and traditions. Here are some of the best festivals in Panama that you should not miss.

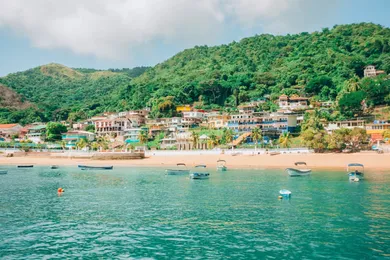

Coronado beach is one of panamas best places to retire. Learn more about the history, location, and activities in Coronado for expats and retirees.

Shopping in Panamas longest pedestrian-only street means bargains for those who enjoy shopping until they drop.

Explore the best places to retire in Panama with our comprehensive list. Find your ideal retirement haven in Panama’s diverse and welcoming communities.

Experience the magic of the annual Flower and Coffee Festival in Boquete, Panama. Discover why Boquete is called the flower capital of Panama.

Discover Panama's Ride-Share services: your ultimate guide to ride-sharing in Panama City. Get tips, pricing, and insights.

The Panama Canal is far more than just a waterway between the world's largest oceans. This engineering feat took two attempts and 34 years to complete.

At Your Panama, our mission is to empower expats and retirees with the information, resources, and insights they need to embark on a transformative journey to Panama. We're dedicated to guiding individuals through the process of relocating, investing, and thriving in this enchanting country.

Through a wealth of tailored articles and guides, we're here to be your trusted companion as you explore the endless possibilities and embrace the enriching lifestyle that Panama offers. Join us in making your Panama dream a vibrant reality.

Four bedroom villa in a small garden community a mere 350 yards from the ocean.

Tropical plantation style housing at its very best. $279,000 for this immaculate home with swimming pool.

60 acre private off-grid community with ocean view sites. 30 minutes from Bocas Town, Panama by boat.

Pacific ocean front Hawaiian style home. Superb location, close to town.

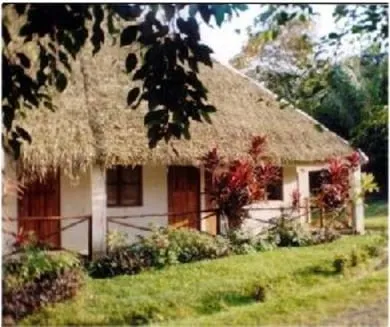

Secluded Highland retreat cottage in the pristine mountains of Panama with 1.5 acres of land.

Bocas Del Toro tropical island dream home on 6 acres on San Cristobal Island.

Ground floor furnished two bed condo in established Hacienda Los Molinos community with stunning views.

La Granja: Eco-resort near Panama City with 12 rooms, pool, and nature-focused amenities on 27.85 acres.

Subscribe to our newsletter for awesome Panama expat insights and tips.